Section 179 calculator

Section 179 Tax Deduction calculator an easy to use calculator to estimate your tax savings on equipment purchase through section 179 deduction in 2019 and tax year 2018. Simply enter in the purchase price of your equipment and let the calculator take care of the rest.

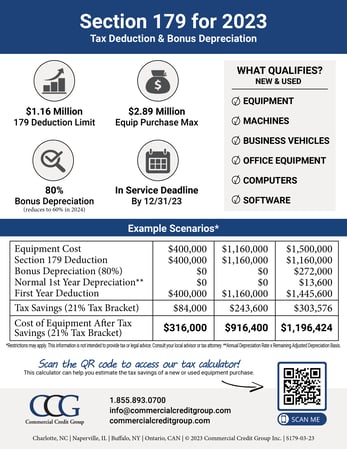

Section 179 Calculator Ccg

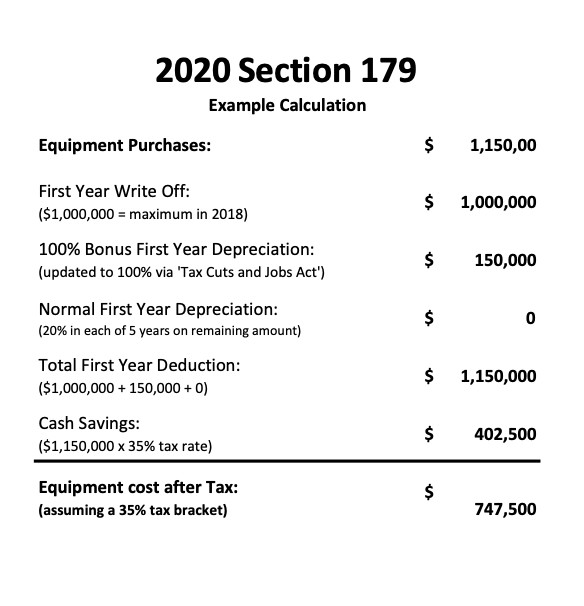

Once you hit the Section 179 deduction limit you may also qualify for Bonus Depreciation.

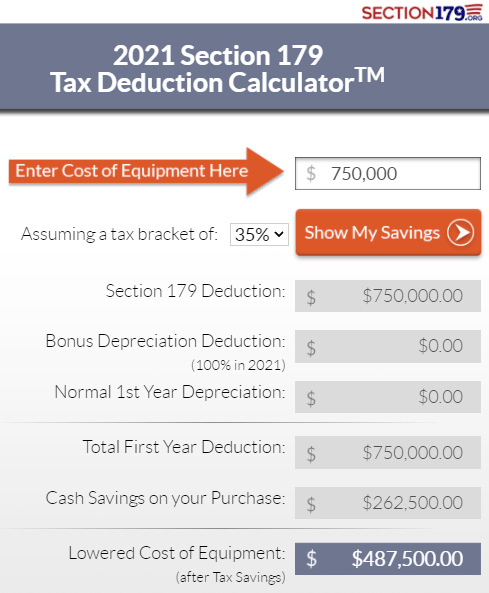

. See How Much Money Can Section 179 Save Your Business. Use the Section 179 Deduction Calculator to help evaluate your potential tax savings. Section 179 can save your business money because it allows you to take up to a 1080000.

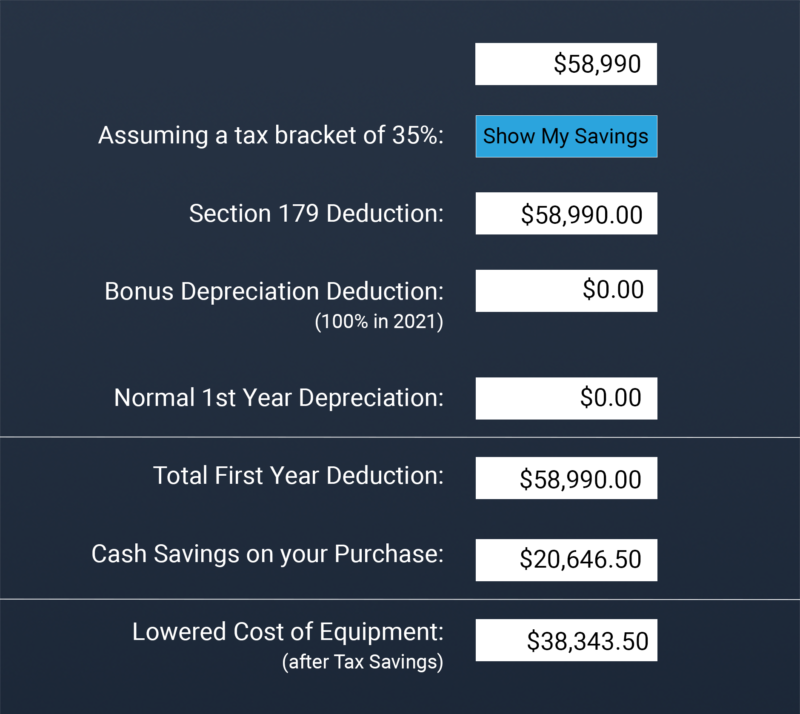

Heres an easy to use calculator that will help you estimate your tax savings. All figures displayed on this Section 179 calculator are estimates for your general. Check with your tax specialist to get the full advantages of IRS Section 179.

Just enter your equipment price and select your tax. All you need to do is input the details of the equipment select your tax. Companies can deduct the full price of qualified equipment purchases up to.

Calculate your potential savings with our 2022 Section 179 tax. Calculate your potential savings. Qualified purchases can be written off as an expense during.

Use Our Section 179 Deduction Calculator To Find Out. Essentially Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment andor software purchased or financed during the tax year. The Section 179 deduction limit for 2021 is 1050000.

This free Section 179 calculator for 2022 can help you determine how much tax you can save. Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021. Section 179 Deduction Limits for 2021.

The Section 179 Deduction and Bonus Depreciation apply. Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment andor software financed during the tax year. Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased 3670000 in 2021.

That means that if you finance. Leveraging Section 179 of the IRS tax code could be the best financial decision you make this year. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly lower the true cost of the equipment purchased.

Section 179 calculator for 2022. Our easy to use calculator that will help you estimate your savings. Contents of Section 179 Deduction Calculator.

Section 179 allows you to subtract the cost of certain types of assets from your balance sheet. What are my tax savings with Section 179 deduction. Enter an equipment cost to see how much you might be able to deduct.

For passenger vehicles trucks and vans not meeting the guidelines below that are used more than 50 in a qualified business use the total deduction including both the Section 179. This means your company can deduct the full cost of qualifying equipment new or used up to. Section 179 of the IRS tax code gives businesses the opportunity to deduct.

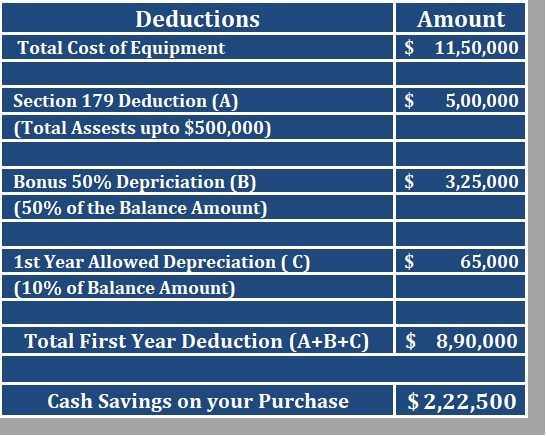

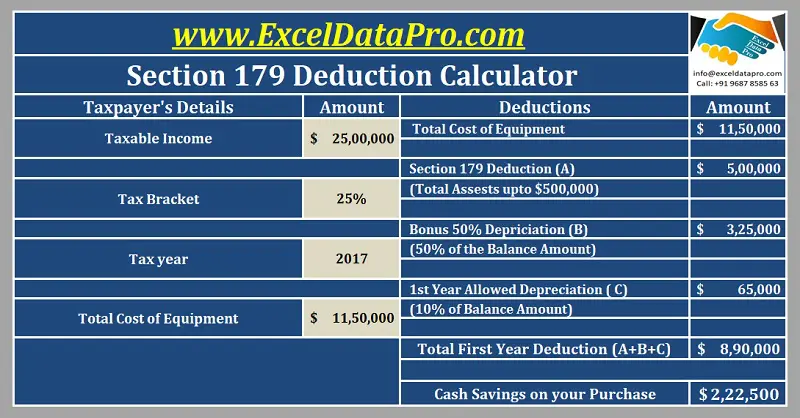

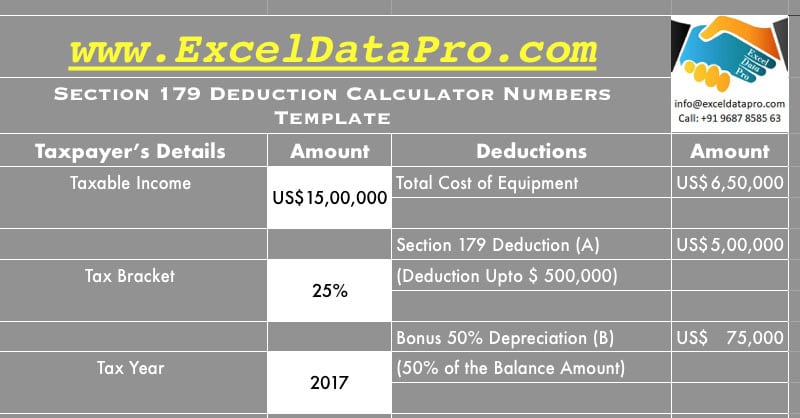

Its especially profitable when combined with equipment financing. For 2021 Bonus Depreciation is 100. Section 179 Deduction Calculator consists of 2 sections.

You can use this Section 179 deduction calculator to estimate how much tax you could save under Section 179.

Section 179 Tax Savings When You Buy Now Dt Photo

The Current State Of The Section 179 Tax Deduction

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Smart Dtg Printer Owners Take Advantage Of The Section 179 Tax Deduction Ricoh Dtg

Bellamy Strickland Commercial Truck Section 179 Deduction

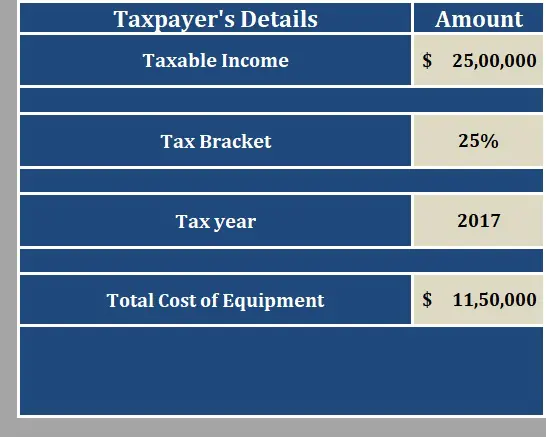

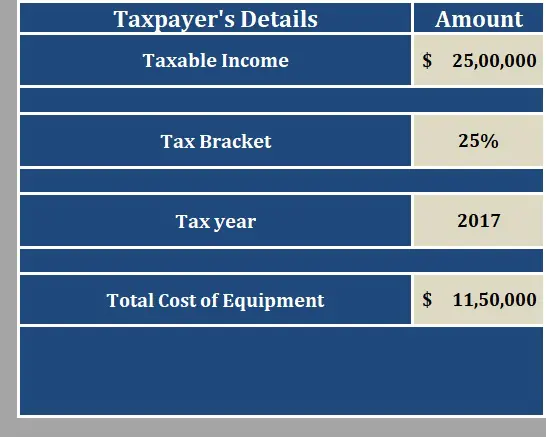

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Download Section 179 Deduction Calculator Excel Template Exceldatapro

2020 Section 179 Commercial Vehicle Tax Deduction

Section 179 Tax Deduction Official 2019 Calculator Crest Capital

2021 Section 179 Tax Savings Your Business May Deduct 1 050 000 Youtube

2021 Section 179 Deduction Tax Incentive Purple Platypus

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Download Free Federal Income Tax In Templates Apple Numbers

Write Off Your Entire Purchase In 2020 With Section 179 Deduction Advancedtek

Section 179 Deduction Fmi Truck Sales And Service Oregon

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Section 179 Calculator Ccg